With the advent of on-line market information, the services provided by commercial real estate professionals have fundamentally changed. In the past, a major component of the service provided to clients was the ability to “find the space.” Now anyone can access such databases as CoStar, Reid and Xceligent and as a result, all real estate professionals have essentially the same market information. A commercial tenant representative is now more of a consultant/advisor than a “space finder.”

At the same time, we have had a vast global consolidation of real estate companies in which such firms as CBRE, JLL, Cushman & Wakefield and others have acquired a variety of service providers both nationally and internationally in the process of becoming giant public companies. Most of our major competitors provide leasing, management, facilities management, appraisal, and brokerage services. Today we find tenant advisors, landlord leasing specialists, capital market professionals and building management operators all under the same roof.

At a time when many users of commercial space are expecting and requiring more information and direction from their real estate advisors, many of those same advisors have layered their operations with giant conflicts of interest. Handling those conflicts is now an ongoing problem in the “full-service” firm’s business model but don’t take our word for it! Just look at the paragraph below from CBRE’s 2020 Annual Report:

“Similar to other global services companies with different business lines and a broad client base, we may be subject to potential conflicts of interest in the provision of these services. For example, conflicts may arise from our role in advising or representing both owners and tenants in commercial real estate lease transactions. In certain cases, we are also subject to fiduciary obligations to our clients. In such situations, our policies are designed to give full disclosure and transparency to all parties as well as implement appropriate barriers on information-sharing and other activities to ensure each party’s interests are protected; however, there can be no assurance that our policies will be successful in every case. If we fail, or appear to fail, to identify, disclose and appropriately address potential conflicts of interest or fiduciary obligations, there could be an adverse effect on our business or reputation regardless of whether and such claims have merit. In addition, it is possible that in some jurisdictions, regulations could be changed to limit our ability or market share in those markets. There can be no assurance that potential conflicts of interest will not materially affect us.”

We believe that the major loser in this situation is the tenant in the market looking for space due the following reasons:

• Full-Service firms use the tenant representatives as bait for acquiring landlord listings. When they pitch for earning the right to list an office or industrial property one of the prime selling points is all the tenants represented by their firm

• Many of these owners have large portfolios with hundreds of transactions happening on an annual basis and the income stream from the portfolio (including leasing commissions, management and construction management fees and capital markets transactions) is far more important to the full-service firm than any individual lease transaction. In some cases, the consultant/advisor is even a landlord themselves!

• The tenant is typically only out looking for space every 5 or 10 years and they have no way of knowing whether their requirement has been compromised as collateral damage due to “their” consultant/advisor having to tread lightly due to other relationships in their firm.

In addition to the conflicts outlined above, there is another factor that public companies require that does not benefit a tenant. Wall Street requires public companies to project and report their income on a quarterly basis. As, if or when a public company doesn’t deliver on those projections, they get punished in the market place. A real estate transaction, on the other hand, is not governed by those issues. Good timing is a combination of client needs, market fluctuations, space availability and other factors. Any attempt to manipulate the timing on closing a transaction can put the tenant’s interests at risk. When the consultant/advisor is under pressure from his or her management to deliver on projects, the client’s optimum solution could be compromised.

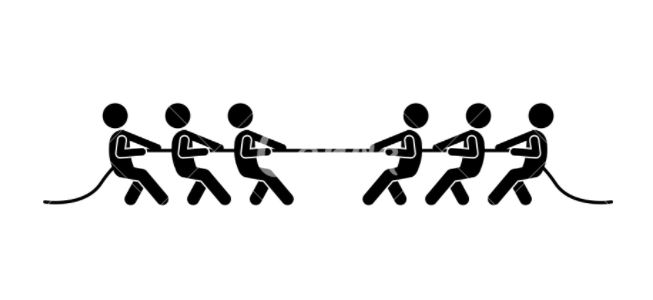

Fundamentally, how can a broker in a conflicted public company push for the best deal if his company views the landlord as more valuable than the tenant or in some cases where the brokerage company is the landlord? When your advisor is negotiating directly with his or her employer or one of their firm’s most important clients, is it reasonable to expect that they are willing to push and trade as hard as possible? Common sense should tell you that your advisor should not have conflicting loyalty at the negotiation table.

Fritsche Anderson Realty Partners is the largest privately owned tenant-only real estate brokerage company in Houston.